Markets in a Minute: Will the Inflation Reduction Act Actually Reduce Inflation?

The Inflation Reduction Act, which has been signed by the President and has passed the House, has been heralded as a major legislative victory for the Democratic party. The bill includes a long list of disparate agenda items including lower prescription drug costs, charges for stock buybacks and incentives to combat climate change, all tied with the bow of the politically popular idea of “lower inflation.” But will it really matter for the economy or the markets?

Reactions to the new legislation range from “tax costs exponentially outweigh benefits” to that the bill will “lower costs, create jobs, and help fight inflation”. As is common when it comes to politics, the answer lies somewhere in between: while the bill is unlikely to cause lower inflation (that appears to be happening on its own) it will also not significantly increase taxes.

For companies, the two most impactful parts of the legislation are a new minimum 15% corporate alternative minimum tax and a new 1% tax on share repurchases.

- Congress’ Joint Committee on Taxation estimates that fewer than 150 companies will be subject to the new minimum tax rate, about half of which are in manufacturing, though the new law still allows for exemptions related to equipment purchases which could help blunt the impact to manufacturing companies. The higher minimum tax rate is expected to raise about $200 billion in new corporate tax revenue, equating to an increase of less than 5% over that time frame.

- The 1% tax on share repurchases is expected to raise an even more modest $74 billion over the next decade, and will go into effect at the end of this year, provided the law is passed. That start date allows companies time to accelerate repurchases before the new tax goes live – so expect to see additional share repurchase activity before the end of the year.

- Once the new tax goes into effect, it could slow companies’ propensity to buy back their own stock. In turn, those firms could buy back less stock, allow the extra cash to sit on their balance sheet, or increase dividends. Whichever path companies choose, that would leave less money for stock owners, though this would only be a marginal change. For context, over the last few years, companies in the S&P 500 have spent about $800 billion per year in stock buybacks.

Will the bill actually bring down inflation?

- The rapidly rising price levels that the US economy currently faces are driven by factors that are largely outside of the government’s control: the aftereffects of covid shutdowns and war in Ukraine. As such, there is only so much that the government can actually do.

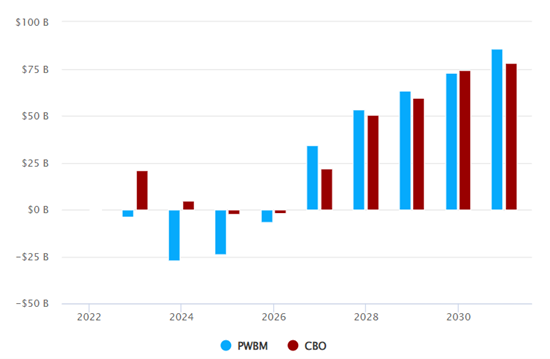

- Both the government’s own Congressional Budget Office and the University of Pennsylvania’s Penn Wharton Budget Model suggest that the bill will have a negligible impact on inflation. Though both analyses agree that by year 5, the new provisions would contribute to reducing the deficit.

Inflation Reduction Act of 2022, Effect on the Budget

Net deficit reduction (+) or increase (-) from spending and revenues

Sources: Penn Wharton Budget Model, Congressional Budget Office

Is inflation slowing?

- Last week we had the first official report showing that inflation levels may have peaked. The consumer price index increased by 8.5% compared to the previous year and was flat compared to the prior month.

- This difference between year-over-year change and month-over-month was the source of yet another political debate between Left and Right. So, who was correct? Well, both. While year-over-year increases in prices are what hurts consumer pocketbooks, the leveling off from the previous month provides a clue that overall price increases may be slowing. It is this latter point that sent stocks soaring.

Consumer Price Index

Level of consumer prices and rate of change over different time periods

Sources: U.S. Bureau of Labor Statistics, Kestra Investment Management

Inflation is an enormously difficult beast to tame. The good news is that inflation does indeed appear to be slinking back to its cage thanks to the easing of global supply chain disruptions and the Federal Reserve’s tightening of monetary policy. And the stock market has been applauding.

The real legacy of the new legislation will be in providing additional funding for health care and clean energy. Individuals will have their own opinions on those topics, but they are thankfully outside my purview. What I can say is that the Inflation Reduction Act is not likely to lower inflation, just as it is also not likely to hamper corporate profitability. Take that Left and Right.

Invest wisely and live richly,

Kara

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Private Wealth Services, LLC, Kestra Investment Services, LLC, Kestra Investment Management, LLC, Bluespring Wealth Partners, LLC, and Grove Point Financial, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Private Wealth Services, LLC, Kestra Investment Services, LLC, Kestra Investment Management, LLC, Bluespring Wealth Partners, LLC, and Grove Point Financial, LLC does not offer tax or legal advice.